PAMM Accounts: A Comprehensive Guide for Forex Trading

The Forex market, known for its liquidity and flexibility, is an appealing platform for many investors. Among various investment strategies, PAMM accounts have gained attention due to their unique structure and potential for returns. forex trading pamm accounts Hong Kong Trading Platforms showcase these opportunities effectively, providing traders and investors a way to engage in Forex trading without direct involvement in the market.

What is Forex Trading?

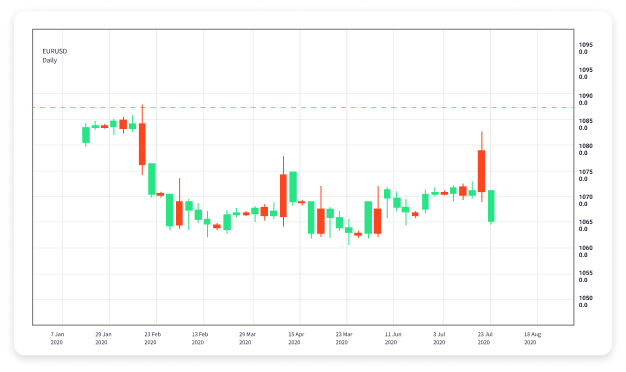

Forex trading involves buying and selling currencies in pairs (e.g., EUR/USD, USD/JPY). The Forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. Traders speculate on currency price fluctuations, aiming to profit from these movements. The market is accessible 24 hours a day, five days a week, enabling participants from various backgrounds to engage in trading activities.

Introduction to PAMM Accounts

PAMM, or Percentage Allocation Management Module, is a trading account structure that allows investors to allocate their funds to professional traders who manage these investments on their behalf. In a PAMM account setup, all profits (or losses) are distributed proportionally based on the contribution each investor has made. This system combines the benefits of managed accounts with the transparency of Forex trading.

How PAMM Accounts Work

1. **Fund Managers**: At the core of PAMM accounts are experienced traders who operate the accounts, executing trades on behalf of the investors. Fund managers often have a proven track record and robust trading strategies.

2. **Investors**: Individuals looking to invest in Forex but lacking the necessary skills or time can allocate their funds into a PAMM account. They choose fund managers based on past performance, strategies, and risk levels.

3. **Profit Allocation**: When the fund manager makes a profit, the earnings are shared proportionally among all investors, based on their contribution. Conversely, losses are also shared, and investors must consider this risk before investing.

Benefits of Using PAMM Accounts

PAMM accounts offer several advantages for both traders and investors:

1. Access to Professional Trading

Investors can tap into the expertise of skilled traders, making it suitable for those who may not have the knowledge or experience to trade independently.

2. Diversification and Risk Management

By allocating funds to multiple PAMM accounts, investors can diversify their risks across various strategies and markets.

3. Transparency and Control

Investors can track the performance of their PAMM accounts in real-time. Most trading platforms provide detailed performance metrics and reports, ensuring transparency in how funds are managed.

4. Minimal Involvement Required

PAMM accounts allow investors to engage in Forex trading without the need to manage their investments actively. This hands-off approach suits busy professionals or those new to trading.

Risks Associated with PAMM Accounts

While PAMM accounts offer unique investment opportunities, they are not without risks:

1. Dependence on Fund Managers

The success of a PAMM account heavily relies on the fund manager’s skills. Poor decision-making or a lack of strategy can lead to significant losses.

2. Market Volatility

The Forex market is volatile, and unforeseen economic events can impact currency values dramatically. Investors should be prepared for potential market swings that can affect their investments in PAMM accounts.

3. Limited Control

Investors do not have direct control over the trading decisions made by fund managers, which can be unsettling for those who prefer a more hands-on approach to their investments.

Choosing the Right PAMM Account

Selecting the right PAMM account involves careful consideration of several factors:

1. Performance History

Review the performance history of potential fund managers. Look for consistent returns and an acceptable level of risk.

2. Risk Management Strategies

Evaluate the risk management techniques employed by the fund manager. A robust risk management plan can help mitigate losses during market downturns.

3. Fees and Charges

Be aware of the fee structures associated with PAMM accounts. Some fund managers charge performance fees, while others may have management fees. It’s essential to understand how these fees will affect your overall returns.

4. Regulatory Compliance

Ensure that the broker offering the PAMM account is regulated and has a good reputation in the market. This helps safeguard your investments.

Best Practices for Investors in PAMM Accounts

To maximize your potential returns and mitigate risks in PAMM accounts, consider these best practices:

1. Start with a Demo Account

If you’re new to PAMM accounts, consider starting with a demo account provided by many brokers. This allows you to understand the system before investing real money.

2. Diversify Your Investments

Allocate funds across multiple PAMM accounts, which can reduce overall risk and enhance potential returns.

3. Stay Informed

Monitor market trends and economic news that may affect currency prices. Staying informed will help you make better investment decisions.

4. Communicate with Fund Managers

Establish a line of communication with your chosen fund managers. Regular updates, reports, and discussions can provide insight into their strategies and market outlook.

Conclusion

PAMM accounts represent a viable opportunity for investors looking to participate in Forex trading while leveraging the expertise of seasoned traders. By understanding the concepts, benefits, and risks associated with PAMM accounts, as well as adopting best practices, investors can navigate this complex landscape more effectively. Whether you’re a seasoned trader or a beginner, PAMM accounts offer a unique avenue to potentially grow your investments in the dynamic world of Forex.